michigan use tax registration

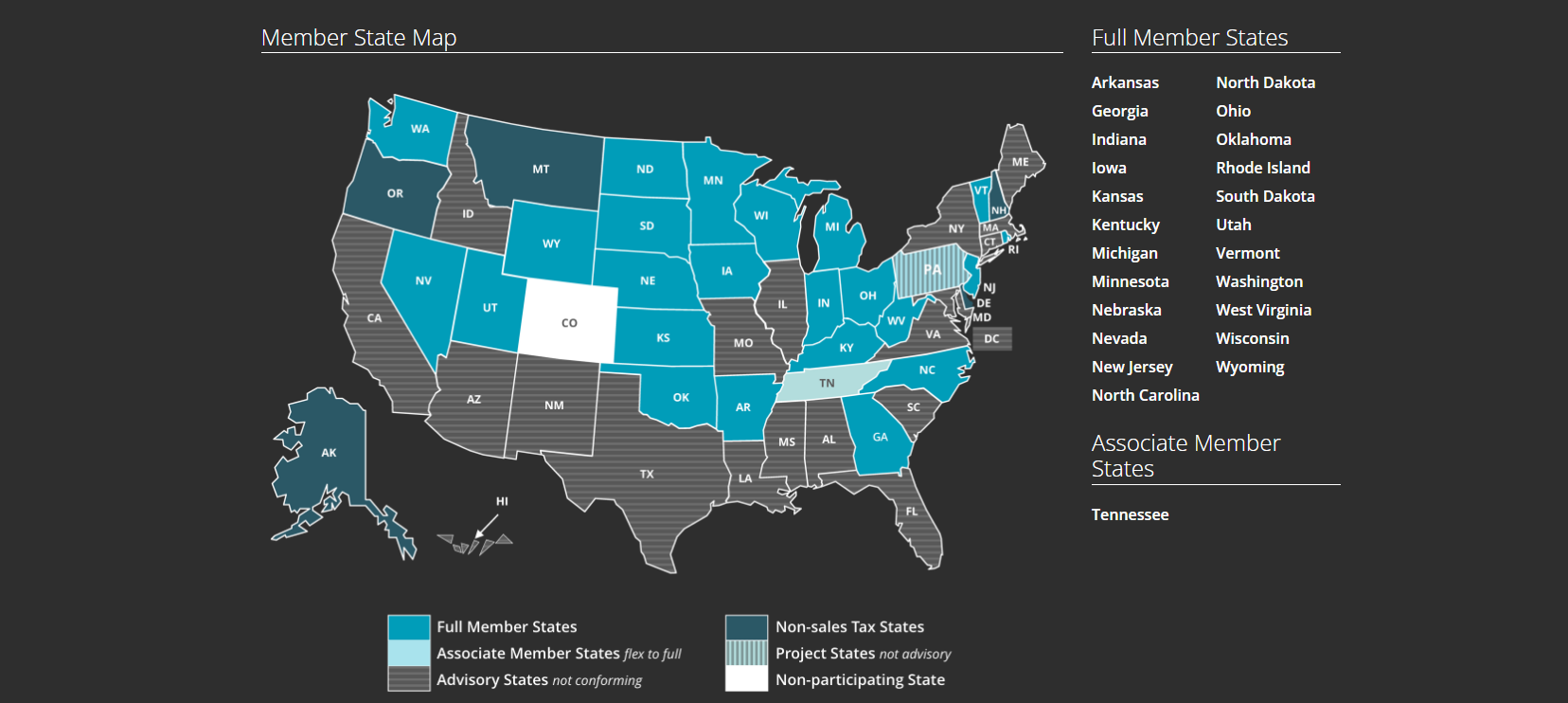

Streamlined Sales and Use Tax Project. LoginAsk is here to help you access Michigan Sales And Use Tax.

Michigan Voters Could Decide On Sales Tax Hike To Fix Roads Wpbn

LoginAsk is here to help you access Sales Tax Registration Michigan quickly and.

. Sales Tax Registration Michigan will sometimes glitch and take you a long time to try different solutions. This section applies to businesses that are applying for a license in Michigan for the first time. Obtain a Duplicate Michigan Vehicle.

To Register for Withholding Tax. MTO is the Michigan Department of Treasurys web portal to many business taxes. LoginAsk is here to help you access Michigan Sales Tax Registration.

This license will furnish your business with a unique sales tax number. Register for a Michigan Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. 20526 - Use tax registration.

A copy of your insurance. Welcome to Michigan Treasury Online MTO. The e-Registration process is much faster than registering by mail.

Taxes - Registration Forms - Michigan. This e-Registration process is much faster than. For more information visit the MTO Help Center.

A cover letter with. Sales Use Tax Licensure. This process is easy fast secure and convenient.

Michigan has a flat income tax rate of 425. Sales Use and Withholding Tax Due Dates. Complete Treasurys registration application.

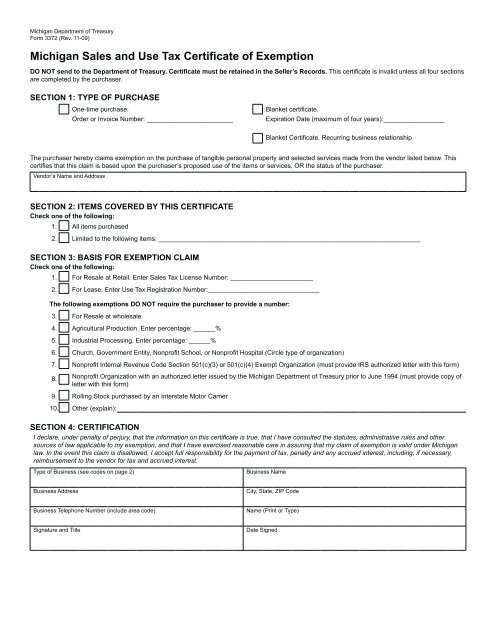

Notice of New Sales Tax Requirements for Out-of-State Sellers. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in. If you elect to pay use tax on receipts from the rental or lease you must first obtain a Use Tax Registration before you acquire the property.

In a follow-up press release her office said The 2000 rebate for a new electric vehicle and 500 rebate for at-home charging infrastructure can be paired with the 7500. E-Register via Michigan Treasury Online. Vehicle title late fee.

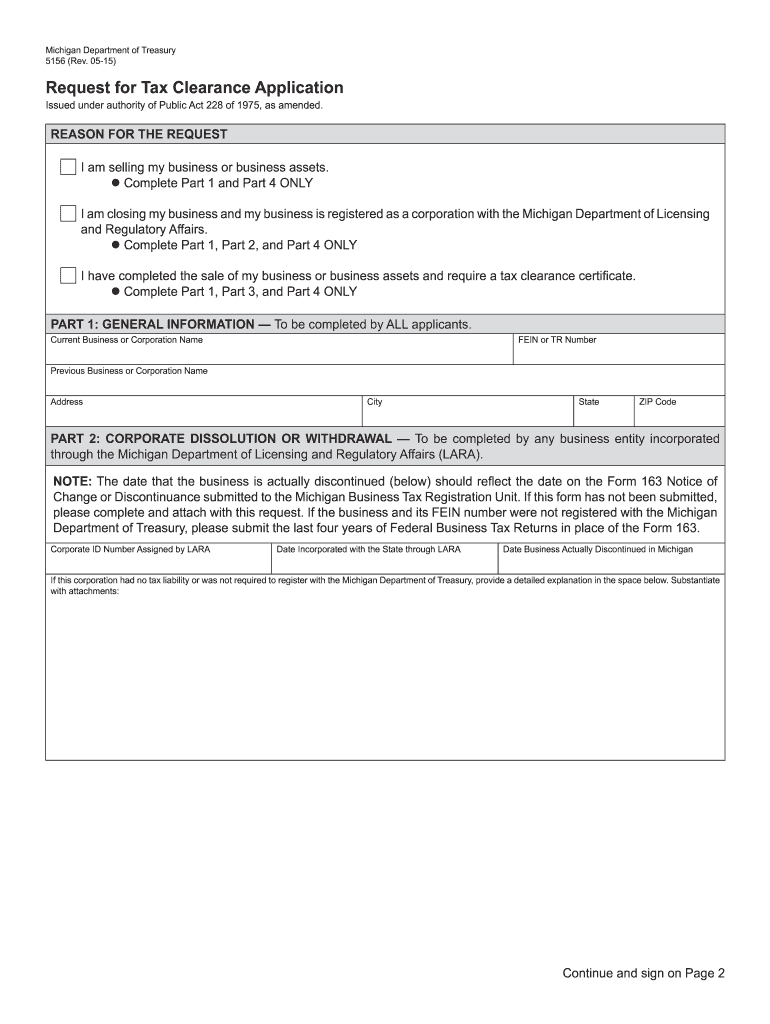

Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country. Michigan Department of Treasury. Michigan manages state payroll taxes through the Michigan Department of Treasury.

E-Registration applications are processed within 5-10 minutes of. 1 Activities that require a registration under the use tax act include but are not limited to all of the following. Minimum 6 maximum 15000 per.

20526 - Use tax registration. 2022 Michigan state use tax. An on-time discount of 05 percent on the first 4 percent of the tax.

Michigan Sales Tax Registration Online will sometimes glitch and take you a long time to try different solutions. A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518. Vehicle registration transfer fee.

The MI use tax only applies to certain purchases. If the business has a federal Employer Identification Number EIN the EIN will also be the Treasury business account number. Michigan Sales And Use Tax Registration will sometimes glitch and take you a long time to try different solutions.

Your daytime phone number with the area code. As of March 2019 the Michigan Department of Treasury offers. Vehicle registration late fee.

Treasury is committed to protecting sensitive taxpayer. The Michigan Department of Treasury offers an Online New Business Registration process. The address where you want your new registration sent.

After completing the online application you will receive a. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Michigan Local City Payroll.

If you have questions about the sales tax license the Michigan Department of Treasury has a guide to the Michigan Sales Use Tax or can be contacted by calling 517-636. Your license plate number. Keller Is an IRS Approved e-File.

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Streamlined Sales Tax Free Solution For Online Sellers

Michigan Sales Tax License Northwest Registered Agent

We Have A Crisis Lawmakers Push State Gas Tax Suspension Woodtv Com

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

How To Get A Business License In Michigan 2022 Forbes Advisor

Sales Tax License Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan State Veteran Benefits Military Com

Michigan Gas Tax Vehicle Registration Set To Rise Wtol Com

Mi Sales Tax Exemption Form Animart

Michigan Ifta Fuel Tax Requirements

Michigan Sales Tax Quick Reference Guide Avalara

Form 485 Fillable Instructions For Collecting Vehicle Sales Tax From Buyers Who Will Register And Title Their Vehicle In Another State

Michigan Ev Owners Register Now Or Get Hit With An Extra 100 200 Registration Fee And 35 Gas Tax Electrek

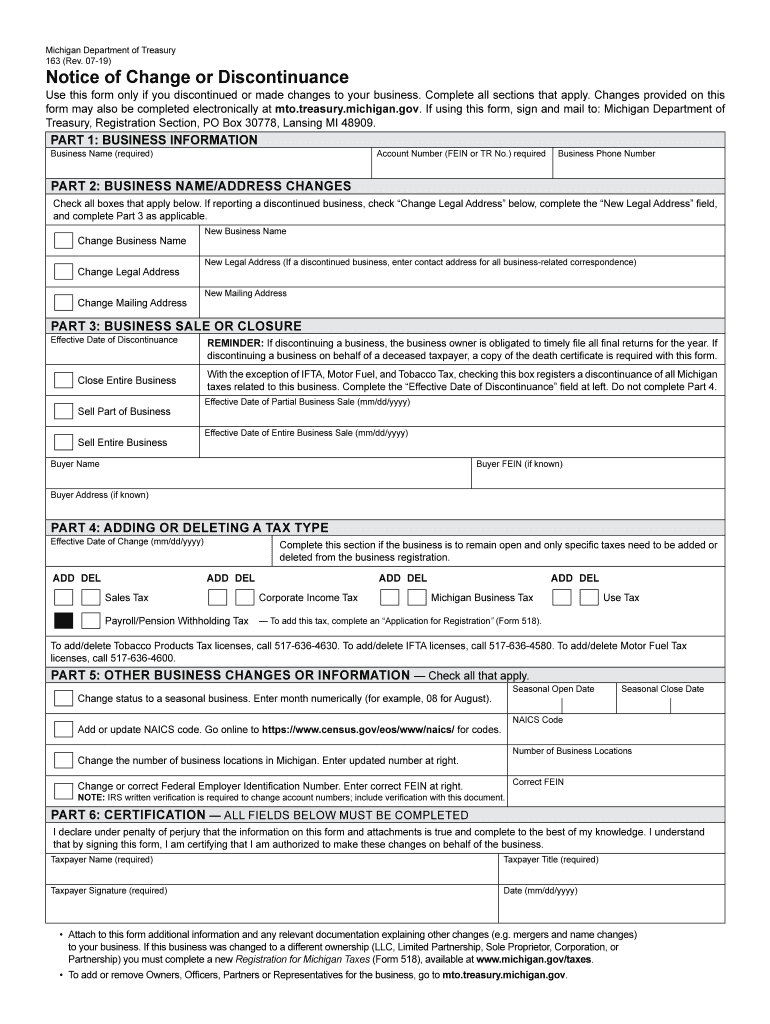

Mi Dot 163 2019 2022 Fill Out Tax Template Online Us Legal Forms