what is a tax lot property

Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. You dont have to be the property owner to access this.

Zoning Lot Vs Tax Lot Nyc Zoning Fontan Architecture

A tax lot is a legal site for a property to be taxed.

. The market value of your property is assessed by using one. A tax lot is a record of the details of an acquisition of a security. A tax lot is a record of the details of an acquisition of a security.

Shares purchased on the same day at. Report a change to lot lines for your property. You have to deduct investment expenses as a 2 percent itemized deduction on Schedule A.

The Department of Finance DOF collects more than 358 billion in revenue for the City and values more than one million properties worth a total market value of. A tax lot is a record of all transactions and their tax implications dates of purchase and sale cost basis sale price involving a particular security in a portfolio. Appeal a property assessment.

Each acquisition of a security on a different date or for a different price constitutes a new tax lot. Visit your local tax assessors website and search for the property by its address or in some cases the owners name. The Internal Revenue Service or IRS tracks quite a bit of information on securities trades through data sets known as tax lots.

Section Block Lot SBL format. Investing as a part-time gig gives you a much more limited write-off. The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal.

Look up your property tax balance. Its a legal site for a property to be taxed. Property tax is a tax assessed on real estate.

For utility parcels SBLs are grouped in two categories. Situs property is property. Data and Lot Information.

Tax maps show lot lines lot and block numbers street names lot. Tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax. Each acquisition of a security on a different date or for a different price constitutes a new tax lot.

A tax lot is a record of the details of an acquisition of a security. Managing foreclosure proceedings on real property. Its a legal site for a property to be taxed.

Section Block Lot SBL format. Providing tax information to the public. Local governments typically assess property tax and the property.

The official tax maps for Deschutes County are maintained by the Deschutes County Assessors Office Cartography Division. Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property. Each acquisition of a security on a different date or for a different price constitutes a new tax lot.

Issuing warrants on delinquent personal property accounts.

How Often Are Property Tax Rates Assessed In Charlotte

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Tax Deduction A Guide Rocket Mortgage

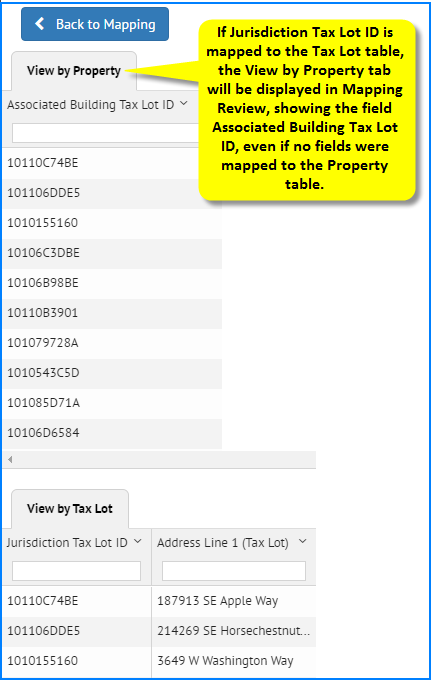

Release Notes Seed Platform Documentation

How Property Taxes Are Calculated On A New Home Moving Com

What Is A Plat Map It Tells You A Lot About Your Property

Understanding Property Taxes Lotnetwork Com

Assessment Taxation Tillamook County Or

Property Tax Calculator Estimator For Real Estate And Homes

Florida Property Tax H R Block

How Property Taxes Apply To Vacant Land Landhub

The Case For Increasing Property Taxes On Vacant Land Chicago Yimby

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

Massachusetts Interactive Property Map Mass Gov

Property Tax Search Taxsys San Francisco Treasurer Tax Collector